SEC Finalizes Climate Disclosure Rules

The SEC has adopted the much-anticipated climate-related disclosure rules, which are almost 900 pages long, two years after they were first proposed. Although the rules will almost certainly face challenges in court that could impact the ultimate timing and scope of their application, registrants should prioritize familiarizing themselves with the rules as the first compliance period rapidly approaches in 2025, especially in light of divergent requirements under other mandatory disclosure programs to which registrants may be subject.

On March 6, 2024, the SEC approved the long-awaited climate-related disclosure rules (the "Final Rules"). While the Final Rules have been meaningfully scaled back from the SEC's original proposed rules that were released in 2022 (the "2022 Proposal"), they will still impose significant new requirements on public companies to disclose:

- Climate-related risks and related risk management and oversight;

- Material Scope 1 and Scope 2 emissions (for large accelerated filers and accelerated filers only);

- Financial statement disclosure describing capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events, if the aggregate amount equals or exceeds certain 1% or de minimis thresholds;

- Material carbon-reduction and other climate-related goals; and

- Financial statement disclosure describing if carbon offsets and renewable energy credits or certificates have been used as a material component of the company's plans to achieve its climate-related goals.

Notably, the proposed Scope 3 emission disclosure requirement and board-level climate-related risk expertise disclosure requirement have been eliminated.

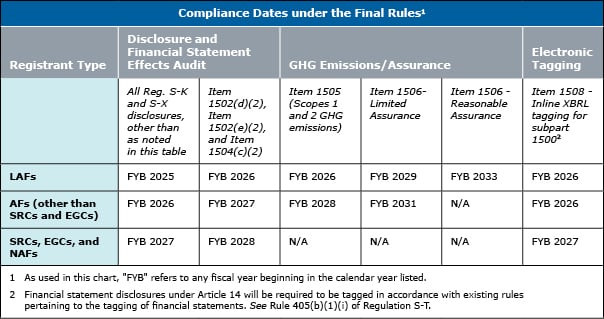

The Final Rules will become effective 60 days after publication in the Federal Register, and compliance will be phased in as follows:

Source: https://www.sec.gov/files/33-11275-fact-sheet.pdf

What's Next?

Registrants subject to the Final Rules will need to consider revising their current reporting practices to account for differing requirements under other mandatory disclosure programs to which registrants may be subject. While regulatory schemes such as California's SB 253, SB 261, and AB 1305 and the EU's Corporate Sustainability Reporting Directive ("CSRD") overlap with the Final Rules, compliance with the Final Rules may not satisfy the full scope of requirements under these other frameworks, and vice versa. Additionally, it is not clear whether reports prepared pursuant to the Final Rules will be recognized as prepared in a manner equivalent to European sustainability reporting standards such that a registrant would not be required to prepare separate reports under the Final Rules and CSRD. Similarly, it is not clear whether registrants will be required to prepare separate reports under the Final Rules and California's mandatory reporting scheme.

The Final Rules are expected to face legal challenges on the basis of the SEC exceeding its regulatory authority and unconstitutionally compelling speech under the First Amendment. Following the Supreme Court decision in West Virginia v. EPA, the "major questions" doctrine could be the basis of a challenge, along with the administrative and compliance burden on companies under the Final Rules. On the other hand, climate-related NGOs have voiced criticisms that the 2022 Proposal was not robust enough and are expected to further challenge the scaled-down Final Rules on that basis. Although it is unclear whether such challenges will stay the issuance of the Final Rules, such challenges could impact their scope.

Stay tuned for our upcoming publication further describing what the Final Rules mean for the companies required to report under the EU CSRD and California's laws.