UK Government Taking Longer With FDI Reviews, but Clearance Rates Higher

In Short

The Situation: On September 10, 2024, the UK government published the third National Security and Investment Act 2021 Annual Report ("2023/2024 Annual Report"), revealing longer processing times for foreign direct investment ("FDI") reviews, but lower rates of Phase 2 call-ins and conditions being imposed.

The Background: The United Kingdom implemented an investment screening regime under the National Security and Investment Act ("NSI Regime") in January 2022, creating a mandatory notification requirement which has caught nearly 1,000 transactions each year, and an ability for the UK government to call in additional transactions that fall outside of the notification thresholds. The 2023/2024 Annual Report provides welcome transparency on the operation of the regime, which has now been in place for nearly three years.

Looking Ahead: Though we see a positive trend toward higher rates of Phase 1 clearances, it will be increasingly important for businesses carrying out activities that fall within the mandatory notification sectors (or investors considering acquiring an interest in such businesses) to ensure compliance with technical notification obligations under the NSI Regime. The 2023/2024 Annual Report discloses more than a doubling of the number of retrospective notifications (where mandatory filings have been missed), and although the UK government has let companies off with formal warnings in past instances of technical noncompliance, substantial financial penalties are increasingly likely going forward.

Total Notifications Continue to Grow Despite a Significant Drop in Voluntary Notifications

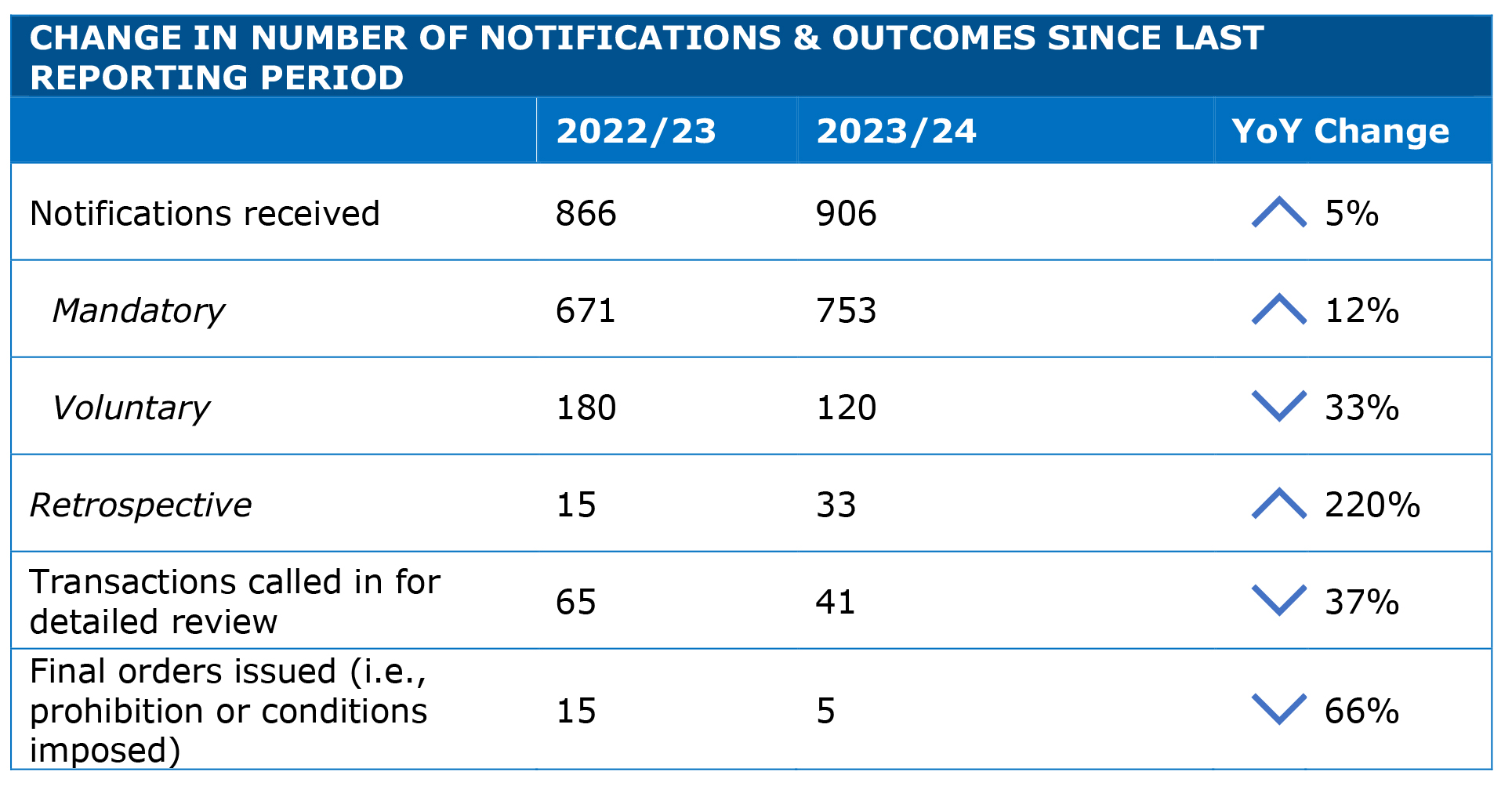

According to the 2023/2024 Annual Report, 906 transactions were notified under the NSI Regime in the last reporting year, a 5% year-over-year increase. The increase in notifications may reflect some increase in M&A activity, but at least partially is likely to reflect increasing levels of awareness and compliance with the mandatory notification requirement as the NSI Regime becomes more established.

Interestingly, all of the growth in notifications comes from an increase in mandatory notifications, while there has been a 33% reduction in voluntary notifications. This reduction can at least partly be explained by the increasing predictability of the UK government's regulatory approach, which has provided parties with greater comfort to close transactions that are not caught by the mandatory notification requirement without engaging in unnecessary voluntary engagement with the UK government.

The increasing awareness of the mandatory notification requirement noted above is also reflected in the 220% increase in applications for retrospective validation for deals that should have been notified but were not. Going forward, the UK government is increasingly likely to move from issuing formal warnings for instances of noncompliance in such cases to imposing financial penalties (where the maximum amount is set at 5% of global corporate group turnover).

Although not the majority of cases, it is noteworthy that a number of such applications for retrospective validation are related to internal restructuring steps taken prior to the sale of a business to a third party, with these missed notifications only coming to light during buyer due diligence. In the past, the UK government has tended to respond to such technical noncompliance by issuing formal warnings. Going forward, however, we expect the UK government to take an increasingly hard line on noncompliance, and this increased risk regarding financial penalties could present significant challenges for parties to transactions where the seller faces a difficult choice between correcting a prior missed notification and facing potential penalties, or losing potential investors unwilling to acquire a business that may have been previously restructured without the necessary clearance under the NSI Regime.

In terms of substantive risk, while the sample size is relatively limited, there has been a positive trend for businesses, with a significant 37% drop in the number of transactions called in for a detailed review and a 66% drop in the number of final orders issued (which contain conditions or prohibit the deal). These changes may reflect differences in the types of transactions coming up for review, but may also reflect that the UK government is becoming more confident in its ability to identify transactions that give rise to genuine national security risks versus those that should be cleared unconditionally.

Areas of the UK Economy in Focus

Businesses carrying out activities that fall within the defence sector definition (which covers direct and indirect suppliers to the UK government of goods or services used or provided for defence or broader national security purposes) continue to make the highest proportion of notifications filed, with 48% of notifications in the reporting period. In a departure from last year, the defence sector also overtook the military and dual-use sector (which, while overlapping with defence, specifically covers businesses carrying out activities in relation to certain export-controlled goods and technology) as the sector that faced the most call-ins for a detailed review. Notably, transactions involving data infrastructure and advanced materials also featured highly on the list.

Acquirer Jurisdictions in Focus

While the mandatory notification requirement under the NSI Regime is agnostic as to the nationality of the acquirer (unlike many other jurisdictions), notifications associated with Chinese acquirers continue to result in the highest proportion of deals called in for detailed reviews, with 41% of all call-ins arising from such notifications. This is particularly notable given that China only accounted for 3% of notifications in the last reporting year, down from 4% the year prior.

Businesses should note that while China was a particular focus for the UK government, acquirers from within the United Kingdom still faced significant scrutiny, accounting for 39% of call-ins, up from 32% the year prior, while transactions involving acquirers associated with close geopolitical allies, such as the United States, France, Canada, and Germany, also continued to face significant scrutiny.

Despite the Higher Clearance Rate, the Review Process Is Taking Longer

As the NSI Regime becomes more mature, the UK government appears to be increasingly able to clear transactions that do not raise issues during the Phase 1 review period. This trend may, however, simply reflect a decrease in transactions involving acquirers associated with China and other jurisdictions seen as politically sensitive. At the same time, the UK government is taking longer to complete those Phase 1 reviews, perhaps indicating that the system is strained for resources.

In particular, while the total number of notifications has only increased modestly and the number of detailed Phase 2 reviews requiring significant regulatory resources has decreased significantly, there has been an increase in the time taken both for mandatory notifications first to be formally accepted (from an average of five working days to seven working days), and then for the UK government to issue a Phase 1 decision (from an average of 27 working days to 29 working days). The time taken to reject a mandatory notification has also increased significantly from an average of 12 working days up to 18 working days in the last reporting period.

Future Reforms Expected

In April 2024, the previous Conservative administration announced a number of proposed reforms to the NSI Regime, some of which have already been implemented. It is expected that the new Labour administration will continue implementation of the remaining proposals, the most of important of which are as follows.

First, the UK government intends to conduct a period of consultation on potential changes to the sector definitions that determine whether mandatory notifications are required. Proposals include creating new standalone sector definitions for semiconductors and critical minerals and bringing transactions involving water companies within the scope of the mandatory notification requirement. These consultations are expected to occur this year.

Second, the UK government is considering potential technical exemptions to the mandatory notification requirement based on the experience gained from the operation of the first three years of the NSI Regime. The UK government has already indicated that it will exempt the appointment of liquidators, official receivers, and special administrators from the mandatory notification requirement, and there will likely be changes to the application of the requirements to certain types of internal reorganisations, among other areas of reform.

It is also possible that we may see more significant changes to the operation of the NSI Regime under the new Labour administration over the coming months, including in the way the secretary of state exercises his considerable discretion under the regime. In particular, we may see a greater focus on security of supply considerations and maintenance of capabilities within the United Kingdom, in light of the chancellor's declaration in March 2024 that "globalisation, as we once knew it, is dead," and her signaling of a renewed focus on forging stronger supply chains, particularly for critical technologies.

Three Key Takeaways

- Although we do not expect a material uptick in the levels of intervention under the new Labour government, we may see a greater focus on conditions addressing security of supply considerations and maintenance of capabilities within the United Kingdom, and these risks should be factored into conditions precedent and regulatory cooperation clauses in transaction documents.

- It is increasingly important to seek regulatory advice in relation to preparatory internal restructuring steps taken in advance of a sale, as these can require separate mandatory notifications (both in the United Kingdom and elsewhere), and failure to notify these steps prior to implementation can give rise to risk of penalties and delays to the main transaction timetable. Similarly, advice should be sought in relation to any internal restructuring steps taken after the main transaction has closed, as these can also trigger mandatory notification requirements.

- The UK NSI Regime is one of many new foreign investment screening systems recently introduced or in development around the world. Investors in cross-border transactions will benefit from early advice on the potential application of such regimes across multiple jurisdictions, in order to take into account their potentially divergent scope and timing when structuring deals.